On January 7, 2024, Argo Biopharma announced two exclusive license and collaboration agreements with Novartis in a historic move in the RNAi therapy field. Argo is set to receive an upfront payment of USD $185 Million from Novartis, with the potential for significant option and milestone payments, as well as a share in commercial sales. The combined potential value of the two deals could reach an impressive USD $4.165 Billion.

Under the first agreement, Argo grants Novartis exclusive global development and commercialisation rights for a Phase 1 clinical product targeting cardiovascular diseases. Additionally, Novartis gains the potential license option for compounds targeting up to two additional cardiovascular disease targets.

In the second agreement, Argo will license to Novartis an exclusive ex-Greater China license to develop and commercialise a Phase 1/2a clinical-stage program for cardiovascular disease treatment.

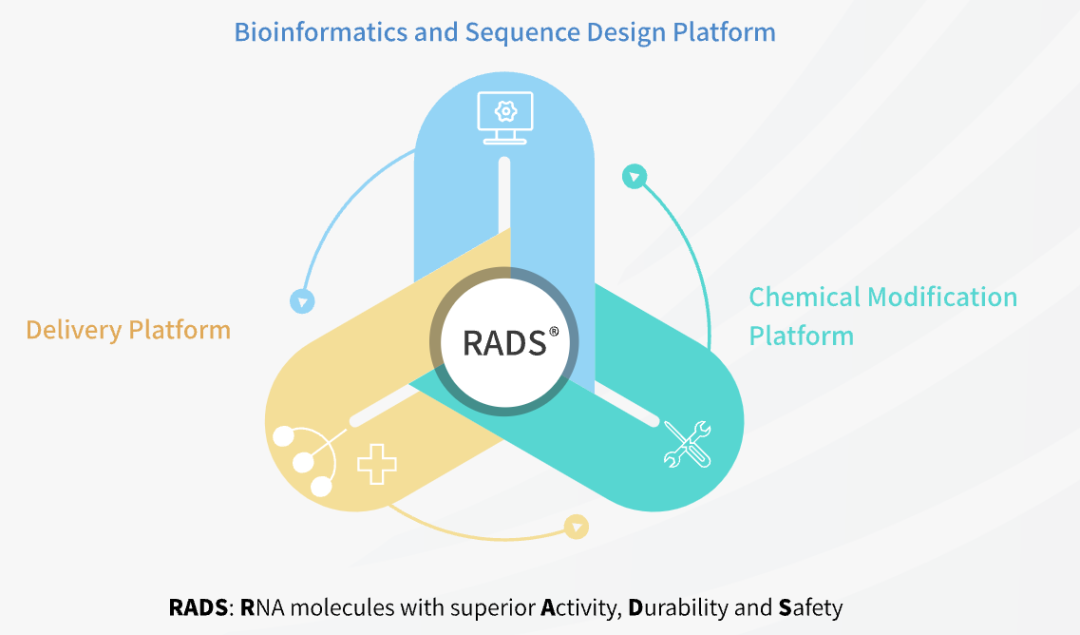

Established in April 2021, Argo is dedicated to siRNA drug development. The company boasts expertise in the entire process of RNAi drug development, including nucleic acid sequence design, chemical modification, GalNAc delivery technology, liver tissue external targeting delivery technology, oligonucleotide synthesis, CMC, and more. Argo has built a comprehensive platform for nucleic acid drug development.

Since December 2021, Argo has completed financing of over US$ 100 Million. TIBS first participated in Argo’s financing in 2021 with continued investments. Argo’s licensing transactions add up to the innovative drug project's overseas licensing transaction for TIBS and related funds, following HiFiBio Therapeutics, Zhimeng Biopharma, Cholesgen (Shanghai), TransThera Sciences and Suzhou Ribo Life Science. We congratulate Argo for their licensing transactions and are grateful to the market and the industry recognitions for our portfolio companies.